Who are first-time homebuyers, exactly, and what are they composed of? Using data from the NAR’s annual Profile of Home Buyers and Sellers the folks over at MGIC put together some interesting facts & insights about first-time homebuyers. Interestingly, 74% rented before buying and 67% said their primary reason for buying a home was out of a “desire to own our own home.”

Women Homebuying Facts

BY BRAD BECKETT ON DECEMBER 2, 2016

What is the purchasing power of women when it comes to buying a home? Mortgage insurer MGIC recently pulled together the following data to illustrate the purchasing power of women when it comes to homebuying. After all, the 2nd largest group of homebuyers, after married couples, are single women. Happy Friday!

Five Real Estate Trends That Will Shape 2017?

BY BRAD BECKETT ON NOVEMBER 30, 2016

The folks over at Realtor.com recently came up with a list of five trends that they believe will shape the world of real estate in 2017. As in years past, their economic team analyzed economic indicators and market data to come up with their predictions for the coming year. Be sure to read the full article to get the gist of their predictions. Remember….everyone has a crystal ball.

The folks over at Realtor.com recently came up with a list of five trends that they believe will shape the world of real estate in 2017. As in years past, their economic team analyzed economic indicators and market data to come up with their predictions for the coming year. Be sure to read the full article to get the gist of their predictions. Remember….everyone has a crystal ball.

“With more than 95% of first-time home buyers dependent on financing their home purchase, and a majority of first-time buyers reporting one or more financial challenges, the uptick we’ve already seen may price some first-timers out of the market,” says Chief Economist Jonathan Smoke, who worked on the realtor.com 2017 housing forecast.

The five trends are:

1. Millennials and boomers will move markets

2. Millennials will look to the Midwest

3. Price appreciation will slow down

4. Fewer homes, fast-moving markets

5. The West will lead the way

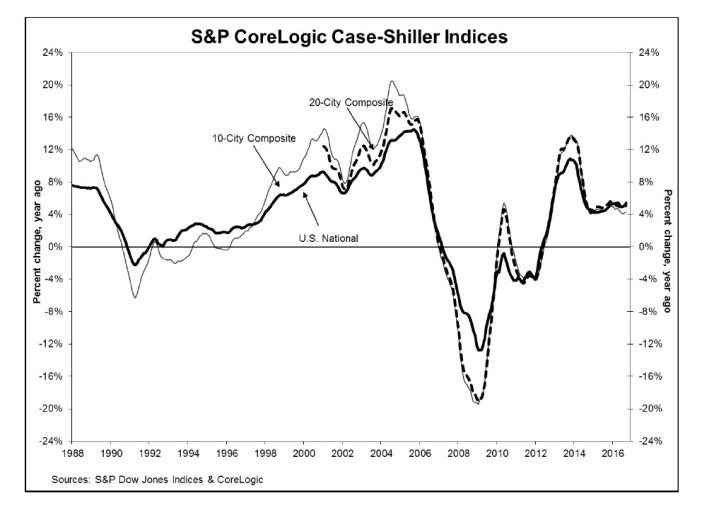

New Peak Marks Shift In Housing Market

This week S&P CoreLogic Case-Shiller released their National Home Price Index which showed that home prices rose 5.5% in September, year over year (up 0.4% from August). Their 10-City Composite posted a 4.3% annual increase and their 20-City Composite reported a year-over-year gain of 5.1%. Seattle, Portland, and Denver reported the highest year-over-year gains among the 20 cities over each of the last eight months. 12 cities reported greater price increases in the year ending September 2016 versus the year ending August 2016.

“The new peak set by the S&P Case-Shiller CoreLogic National Index will be seen as marking a shift from the housing recovery to the hoped-for start of a new advance” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices.

55+ Housing Market Shows Signs of Strength

The National Association of Home Builders’ Eye on Housing recently reported that the 55+ housing market strengthened in 3Q 2016, according to their Housing Market Index. The third quarter results show single-family 55+ housing at 59 points, up 2 points from the previous quarter. This marks the 10th consecutive quarter that the number has remained above 50 on the single-family HMI. The NAHB produces two separate 55+ HMI’s, one for the single-family market, and another tracking the condominium market. The condo HMI was up 1 point at 48.

Click here to read the full report at the NAHB’s Eye on Housing.

Home Prices Continue to Climb

BY BRAD BECKETT ON OCTOBER 27, 2016

The latest S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index says that for August, 2016 home prices continued to rise across the country. The report showed a 5.3% annual gain in August, up from 5.0% last month. In addition, their 10-City Composite posted a 4.3% annual increase, up from 4.1% the previous month and their 20-City Composite reported a year-over-year gain of 5.1%, up from 5.0% in July.

“…While the stock market recovery has been greater than the rebound in home prices, the value of Americans’ homes at about $22.3 trillion is slightly larger than the value of stocks and mutual funds at $21.2 trillion.” Said David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices.

Best & Worst Cities to own Investment Properties?

BY BRAD BECKETT ON OCTOBER 3, 2016

Recently financial information site GOBankingRates.com surveyed 61 of America’s 100 most populous citiesto determine which cities they believe are the best and worst for owning rental property. Using data from Zillow and the U.S. government, they looked at four major factors in their evaluation; Employment Growth, Population Growth, Increase in home values, and Years to pay off property. As with all data like this, take it with the appropriate amount of salt.

Click here to read the full story.

Flippers turn to the crowd for quick cash

BY BRAD BECKETT ON SEPTEMBER 28, 2016

Crowdfunding is hot….and getting hotter. We’re even starting to see more & more success stories and positive media about it. Recently, an article on Bloomberg talked about how home flippers have turned to crowdfunding for their funding needs with great success. Using platform sites such as RealtyShares, LendingHome, PeerStreet and Patch of Land home flippers and developers have learned that financing can be quicker and easier than going through traditional banks.

“[A house flipper] crowdfunded nine deals totaling more than $9 million through RealtyShares over the last two and a half years. A July deal for $1 million took him just 12 hours. “Generally, raising money takes so much time….This offers so much flexibility and time savings. It’s so much better than going to family offices, banks or Wall Street firms.’’

HUD releases 2017 fair market rents

Legislative Update

In late August, the U.S. Department of Housing and Urban Development announced their new FY 2017 Fair Market Rates (FMR’s) which are used to determine payment standards for many housing assistance programs, including Housing Choice Vouchers (HCV) and Project-Based Section 8 programs. HUD’s legal notice indicates that the proposed FMRs will take effect on October 1, 2016 unless interested parties request reevaluation of their FMRs by September 26, 2016.

Airbnb plans to partner with Landlords

by BRAD BECKETT ON SEPTEMBER 14, 2016

Coming on the heels of numerous reports about tenants home-sharing their apartments without landlord knowledge or approval, Forbes is reporting that Airbnb has been working on a new program that will bring owners and landlords of multifamily buildings into its home-sharing service. Airbnb calls it the Friendly Building Program, a new initiative that will let building owners sign up to work with Airbnb and tenants to allow home-sharing on their properties according to mutually agreed upon rules. Airbnb will collect and pay applicable taxes and as well as paying the hosts and the landlords – reportedly around 5% – 15% of their tenants earnings from the program. Not too shabby.

“The program works like this: Building owners—provided they operate in a jurisdiction where short-term rental laws are clear, meaning that there’s no ambiguity nor potential for a regulatory mess—apply for the program. Once accepted, the owner then decides the terms (which units, for how long, revenue division, etc.) under which tenants can rent out their homes and submits them to Airbnb as well as amends its tenants’ leases. Eligible tenants in that can then sign up for their building’s program through Airbnb, and become part of the regular reports the company sends to the landlord.”